How To Stop Obsessing Over Losing Money

Scared of opening your loan statement because of how much interest has accumulated? Tin't cease wondering what not-so-great reports from Wall Street mean for your 401K?

Money problems are stressful, especially when there'south not plenty of it — or you fear there won't exist enough of it in the future.

"Information technology creates this feeling of helplessness and hopelessness," Nancy Molitor, PhD, a clinical psychologist and Assistant Professor of Psychiatry and Behavioral Health at Northwestern University Feinberg School of Medicine, tells NBC News Meliorate. But one of the absolute worst things you lot can practise if you find yourself in this type of situation is ignore the trouble, she adds — "no matter what's causing it."

It'southward kind of like that pile of laundry in your closet. It'south way easier to pretend information technology'south not at that place, only doing and so means it's only going to get bigger by the time y'all demand to deal with it, she says.

Plus, money stress can practise a lot of damage to your health. A new, large dataset that looked at how the recession of the tardily aughts affected our bodies may provide some of the strongest show yet.

The report, published earlier this year in the Proceedings of the National Academy of Sciences, analyzed changes in heart health in a group of 4,600 individuals from before, during, and subsequently the recent financial crunch. (The data was collected for the Multi-Ethnic Report of Atherosclerosis [MESA] betwixt 2000 and 2012.)

On average for everyone in the study claret pressure levels and claret glucose levels — both indicators of worsening heart health — increased during the recession. Just the changes were virtually dramatic in two groups of individuals: those under 65 (people of working historic period) and those over 65 who were homeowners. Both groups include those who may have more than closely felt the furnishings of the recession.

While previous information has looked at associations betwixt people who written report financial stress and health, this written report is unique because it was able to capture specific markers of health gamble at multiple points in time both before and afterward the financial crisis (telling a more consummate story of how that related stress might bear on our health), explains study author Teresa Seeman, PhD, Professor of Medicine & Epidemiology in the David Geffen School of Medicine at Academy of California Los Angeles.

"The MESA data were perfectly aligned to allow us to examine information from before the Bang-up Recession and other information for the same people immediately afterwards [it]."

Whatsoever stress tin can take a toll on your health, merely coin stress may be particularly toxic

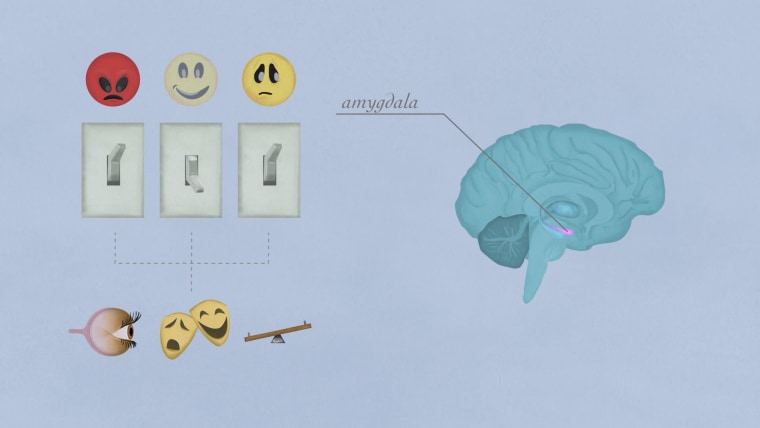

Some stress is the kind you experience when you lot're in firsthand physical danger, which heightens your senses and gives you actress free energy to take activeness (and protect yourself) cheers to the stress hormones your body releases in response, Molitor explains.

But when there is no firsthand physical danger — if the threat is perceived — those hormones that go released terminate up wreaking havoc on your torso. More problematic withal is when those stressors are chronic ones that you lot deal with day subsequently mean solar day, calendar week after calendar week — as is the case a lot of the times when information technology comes to money worries, Molitor says.

"Information technology's a kind of never-ending, seemingly endless loop of problems that gets created if the person doesn't deal with the dilemma," she says. That type of prolonged chronic stress response is associated with developing problems, like obesity, type 2 diabetes, tum ulcers and cardiac problems.

"And uniquely, chronic stress nearly money seems to activate that [fight-or-flight response] system at a very high level," she notes. That means more hormones get released that cause more than damage to the torso.

Indeed, studies show that people with more debt tend to study having higher levels of stress and depression. Other studies propose financial insecurity (such as loss of a job), or even only worrying virtually becoming financially insecure, can increase the amount of physical hurting people report feeling, and increases the corporeality of over-the-counter painkillers people study taking. Other enquiry shows people with more financial stress are more than likely to have metabolic syndrome, a series of poor health markers that put y'all at risk for type 2 diabetes, heart disease and early on expiry.

How to not exist stressed about your finances

The positive takeaway is that coin problems are tangible ones — pregnant you tin can put your finger on what's incorrect, which is the first step to addressing it (and most of the time you tin can do something about it, Molitor says).

Here are some the steps that Molitor and others say can help:

i. Become involved with your finances

Rip open the bills and look at those bank statements. Information technology may be bad, but at to the lowest degree you know how bad it is, and yous eliminate that fear of the unknown.

"By condign more involved and aware in everyday money management, you feel more in command," adds Kathleen Gurney, PhD, CEO of Financial Psychology Corporation and author of "Your Coin Personality: What Information technology Is and How You Tin can Profit from It."

2. Download your stress

Brand a physical list of what you're stressed about — whatever'south been ruminating in your brain in the wee hours of the night, Molitor says. "Y'all'll feel amend just writing it downwards because you're downloading all of those negative thoughts, taking it out of a space where information technology'south taking upwards a lot of energy."

iii. Get a second opinion

Become assistance from a trusted friend, family member, or financial planner to determine the best adjacent steps to take. It'southward not always nigh just paying off the highest debts first; it'southward nigh starting to address the problems on your list that requite y'all the about anxiety and are going to exist wisest for your fiscal wellbeing into the futurity, explains Delynn Dolan Alexander, a Wealth Management Advisor for Northwestern Mutual in Durham, North Carolina.

"And it's hard to make those decisions in a vacuum," she says. Someone with a fresh, objective gear up of eyes tin can offering a different perspective and potentially some financial expertise you don't have yourself.

4. Make a plan

There'southward ane solution that helps all fiscal problems, Molitor says — a program. A lot of people think: "If I just won the lottery, my problems would be solved." A windfall of money might aid, simply no thing what type of paycheck you bring abode or the balance in your bank accounts is, having a roadmap for how you plan to relieve and spend is what's going to make you feel in control of your finances and kick the stress.

Whatsoever the plan, it should take into business relationship your comprehensive financial situation (income, savings, debt, expenses, and spending priorities) and map out the best way to meet your goals given your circumstances, Dolan Alexander adds. And if y'all're working with a financial advisor to brand that plan, exist sure to tell them about all those different aspects of your finances so together you tin determine the best next moves.

5. Follow the plan, and change it if and when information technology'due south non working

Retrieve of a fiscal program as something that's living, animate, and changeable, depending on things like the status of your chore and global economy, Dolan Alexander says. "They need to have some flexibility around changing conditions, whether [those changes] are internal or external."

If you lot're working with a financial advisor, yous should be reviewing your situation at least annually — and more ofttimes if employment changes or yous accrue new debt, have concerns the economy or have other questions about your money management.

vi. Take what's going to be out of reach for you lot

Maybe you lot're not going to be able to buy that new habitation you lot've been wanting to upsize to. Mayhap retiring at 65 isn't going to happen for yous.

Once y'all accept a plan, you lot need to let go of what might not be possible given your fiscal state of affairs — and accept what is, Molitor says. Changing your parameters lets you focus on the things y'all can control, she says. "And yous'll realize, 'I'm going to exist OK.'"

vii. Air your muddied laundry

Peculiarly when it comes to coin, people tend to be embarrassed when things aren't going well, and they don't talk to friends and family nearly information technology like they would other problems.

"Use your social network," Molitor says. Acknowledging what yous're worried nearly and getting support from people who care about you is really important (and can go a long mode in alleviating some of that stress).

eight. Don't ignore what's happening on Wall Street and beyond

Hearing that stocks are down and companies are folding tin can exist unsettling. But just like you shouldn't avoid your personal financial debts and bills, you don't want to totally melody out what'southward going on globally.

"It'due south skilful to exist thinking at the 50,000-foot level. It puts you in a position to brand improve choices," Molitor says.

How to Save More Money

- The one motion you lot can brand to better your wealth and health

- How a do-not-buy list tin salve you hundreds of dollars

- thirteen easy ways to salve coin

- How to upkeep and go out of debt if you lot live paycheck-to-paycheck

Want more tips similar these? NBC News Improve is obsessed with finding easier, healthier and smarter ways to live. Sign upwardly for our newsletter.

Source: https://www.nbcnews.com/better/business/how-stop-stressing-over-money-so-it-doesn-t-hurt-ncna874791

Posted by: dreweswhatitat.blogspot.com

0 Response to "How To Stop Obsessing Over Losing Money"

Post a Comment